Beijing, China — September 9, 2025

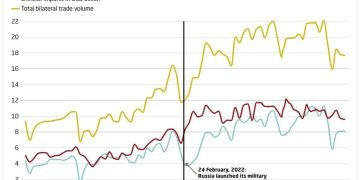

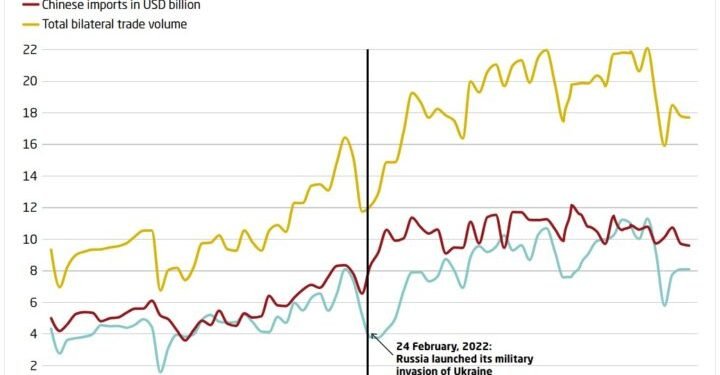

It came quietly, but the numbers tell a warning story. In August, Chinese exports to Russia tumbled — the sharpest drop since March. Factories are slowing, shipments sit longer in ports, and the rumble of unease is growing.

“I’ve seen demand dry up,” sighed a Shanghai-based trade analyst. “Orders canceled at the last moment. Carriers pulling back. No one is quite sure what comes next.”

A sharp fall

August’s trade data showed a decline in exports to Russia that we haven’t seen in half a year. This isn’t just a statistical hiccup. It reflects mounting geopolitical friction, currency headwinds, and a hesitant Russian market. Exporters, already tight on margins, are now grappling with uncertainty on two fronts.

What’s driving it

On one hand, volatile ruble–yuan rates are making Chinese goods more expensive in Moscow. On the other, tighter Western sanctions on Russia are having ripple effects. Some Russian buyers are seeking alternate channels or suppliers — anything to delay or avoid direct exposure. The result: freight bookings drop, and container slots open up overnight.

Next-door warning

For logistics providers in China’s coastal hubs — from Shanghai to Tianjin — the drop isn’t just a number. Warehouses slowly clear, trucking fleets idle, and air-cargo rates begin to wobble. A shift in export lanes this sharp can destabilize supply chains fast, and there’s little time to retool.

What to watch

Will Beijing step in with subsidies or relaxed trade terms? Are logistics operators going to pivot to other markets, like Southeast Asia, to compensate? And crucially, will Russia’s demand recover in time for year-end purchases? The answers aren’t clear yet — but the window for correction is tightening.