Country: United States

Category: maritime

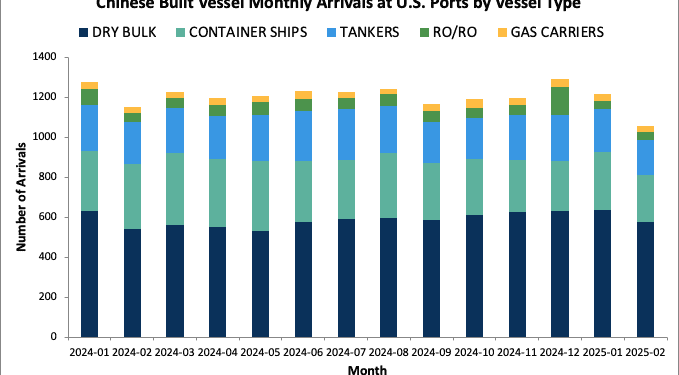

The U.S. is preparing a schedule of targeted port fees on vessels built, owned, or operated by Chinese interests. For carriers, the near-term calculus is complicated: rotate Chinese-built tonnage off U.S. services and accept temporary inefficiencies, or keep fleets as-is and risk fee exposure just as peak season planning tightens. Importers face a budgeting puzzle—advance ship before fees take effect, diversify gateways, or renegotiate contracts with fee-contingent clauses. Exporters, especially in agriculture and chemicals, worry about landed-cost competitiveness into Asia if bunker-plus-fee math escalates all-in rates.

Why it matters: This is a structural variable, not a one-off surcharge. Expect contract re-openers, more index-linked deals, and lane reshuffles through 2026 as procurement teams de-risk exposure.