The Asia-West Africa route is emerging as one of the most dynamic corridors, and shipowners are quickly adjusting their operations. In the face of a marked increase in volumes last year, Maersk and CMA CGM are reorganizing their cooperation to better capture demand and, above all, to streamline operations.

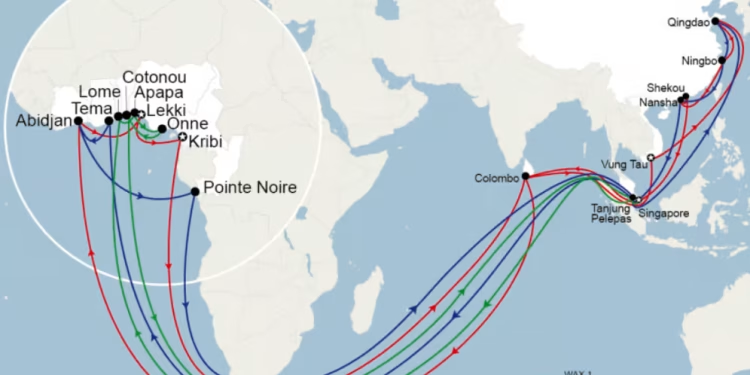

The duo does not simply tweak an existing service: the approach involves splitting a rotation and introducing a new loop, in order to reduce operational complexity and offer a more readable structure. The idea is simple: two more “focused” services are better than a single, overly extended route, which is often more fragile in terms of punctuality. The ports served include Asian export hubs, a transshipment stop, and then key stops in West Africa, reflecting a refocus toward the most promising markets.

In the background, one element is as important as growth: competitive pressure. Other players have already strengthened their presence on this route, which accelerates decisions regarding alliances and cooperations. The addition of capacity can also weigh on freight levels, especially since some spot indices are already showing a less firm trend over several months.

For freight forwarders and shippers, the correct interpretation is as follows: more options, potentially more frequency and flexibility, but increased vigilance on the capacity/demand balance, as it will determine whether 2026 becomes a year of volumes… or a year of tight margins.