DSV is quietly reshaping the air freight map. Without fanfare, the forwarder has decided to stretch its “Shanghai Star” charter operation beyond its usual Asian corridors and push it all the way to Latin America — a route where demand has been rising far faster than traditional capacity can keep up.

People inside the company say the idea came from a simple observation:

shippers moving electronics, fashion goods, pharmaceutical products, and e-commerce parcels from China to Latin America were constantly dealing with unpredictable transit times, long detours through the U.S. or Europe, and too many last-minute cancellations. The charter already running out of Shanghai gave DSV a platform — turning it into a new long-haul bridge was the next logical step.

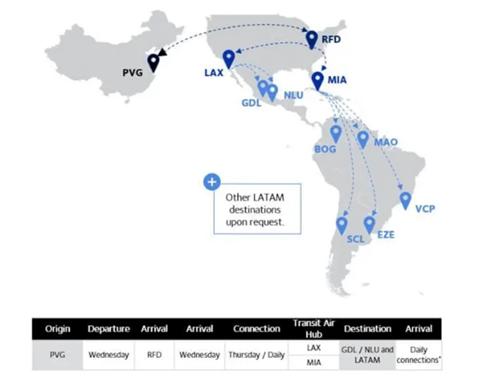

The expanded service now operates several fixed weekly rotations, which is exactly what exporters in the region were asking for: something they can plan around. The product isn’t just a flight — it bundles customs support, inland pick-up and delivery, and controlled-temperature options for shipments that can’t be exposed to rough handling.

Behind the announcement lies a bigger trend. Over the past year, many manufacturers have shifted assembly work toward Mexico, Brazil, and other Latin American economies. The result is a new pattern of trade: components and finished goods moving directly from China to the southern hemisphere, bypassing the usual hubs and creating a need for reliable uplift that airlines alone haven’t been able to supply consistently.

For DSV, locking in charter capacity also acts as a shield against the spot market’s volatility. When rates spike or commercial carriers reshuffle their schedules, customers using “Shanghai Star” avoid the constant uncertainty that has become common in long-distance air freight.

More than anything, this move reflects a broader change in the industry.

Major forwarders are no longer simply filling space — they are designing their own air corridors, almost like private trade lanes. With the new Asia–LatAm extension, DSV positions itself as one of the players actively redrawing how global cargo flows move in 2025 and beyond.