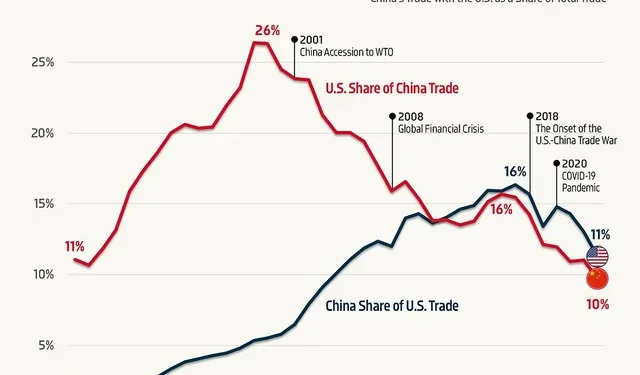

China’s export machine is taking punches again, yet it hasn’t stopped swinging. New data show shipments to the United States have fallen by double digits this year, another chapter in the drawn-out trade standoff between the world’s two largest economies. But the headline number tells only part of the story. Behind it, cargo is moving — just differently.

The trade routes are shifting, the paperwork is thicker, and the patterns that once seemed predictable have started to twist in new directions.

Fewer Direct Sales, More Detours

Charts released this week by several research firms show U.S.-bound exports from China dropping sharply across categories such as electronics, machinery, and household goods. Yet the same report reveals a rise in Chinese shipments to Southeast Asia, Mexico, and Eastern Europe — countries whose own exports to the U.S. are suddenly booming.

It doesn’t take much imagination to see the connection. “Products are moving through new corridors, sometimes one or two steps removed,” said a Hong Kong-based freight forwarder who handles routing for multiple multinational clients. “The supply chain didn’t stop — it just learned how to bend.”

That bending, however, comes with complications: extra transshipments, customs checks, and an undercurrent of suspicion from import authorities trying to spot origin masking.

A Split Market Emerges

Forwarders describe a widening gap between compliant cargo — properly documented, tariff-paid, fully declared — and what one executive called “gray-lane freight,” goods that risk being tagged as rerouted Chinese exports. The latter are often cheaper to move but carry the danger of seizure, reclassification, or delayed clearance.

“Everyone’s walking a fine line,” another operator said. “Clients want savings, but they don’t want their shipment sitting in a U.S. warehouse waiting for an audit.”

For logistics planners, this means more complexity: longer lead times, new inland hubs in third countries, and a wave of last-minute rate changes as carriers adjust for risk premiums.

Resilience, Redefined

Despite the frictions, China’s overall export figures remain surprisingly stable. The composition has changed: fewer consumer gadgets, more electric vehicles, machinery, and intermediate goods headed for assembly elsewhere. Analysts say the numbers point to a different kind of resilience — one driven by adaptation rather than expansion.

Factories have learned to reroute production, sometimes even relocating final packaging just to qualify under new trade codes. It’s not efficiency; it’s survival through agility.

“The trade war hasn’t killed China’s export power,” noted a Shanghai-based economist. “It has simply made it harder to recognize.”

The View Ahead

For freight forwarders, the next few quarters will be defined by uncertainty — tariffs, sanctions lists, and the invisible rules of origin tracing. As global companies keep redrawing their supply maps, logistics teams will need to think less like schedulers and more like strategists.

The routes are longer, the rules tighter, and yet, somehow, the containers keep moving.

That, perhaps, is the real story of China’s export resilience in 2025: a network too vast, too interconnected, and too inventive to stay still for long.